CMOS Image Sensors Expected To Set Record-High Sales for Another Five Years

Automotive, security, medical, and image-recognition systems are replacing smartphones and digital cameras as growth drivers in CMOS image sensors.

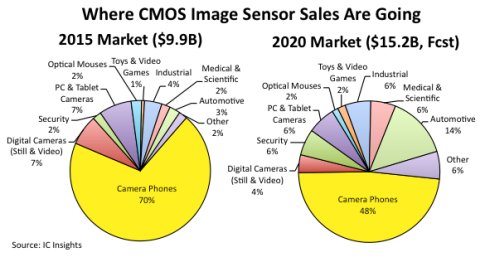

May 4, 2016 -- CMOS image sensors are in the middle of an unprecedented string of record-high annual sales thanks to the rapid spread of embedded digital-imaging technology into a wide range of end-use applications that go far beyond smartphones and stand-alone cameras. According to IC Insights’ new 2016 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes, automotive systems are forecast to be the fastest growing application for CMOS image sensors with worldwide sales rising by a compound annual growth rate (CAGR) of 55% in the next five years to $2.2 billion in 2020, or about 14% of the market’s projected $15.2 billion total (Figure 1).

Figure 1

After the automotive segment, the highest growth rates for CMOS image sensor sales in the next five years are expected to be in security and surveillance (a CAGR of 36% to $912 million), medical/scientific applications (a CAGR of 34% to $867 million), toys/video games (a CAGR of 32% to $274 million), and industrial systems (a CAGR of 18% to $897 million), according to the 360-page 2016 O-S-D Report, which contains a detailed five-year forecast of sales, unit shipments, and average selling prices (ASPs) for more than 30 individual product types and device categories in optoelectronics, sensors/actuators, and discretes. Imaging applications in automotive electronics are the next major market opportunity for CMOS image sensors because more automated safety features are being loaded into new vehicles. Over a dozen image sensors could eventually be used in vehicles to watch passengers, look outside for potential accidents, or record video of crashes or other incidents on the road. Image sensors have already seen strong growth in cars, primarily for rearview backup cameras, but they are also increasingly being used in new collision detection and automatic-braking systems. Efforts to create self-driving cars will accelerate the growth potential for image sensors in the automotive market, says the new O-S-D Report.

Today’s largest CMOS image sensor application—camera phones—is expected to grow by a CAGR of just 1% to $7.3 billion in 2020, or 48% of the market total versus 70% in 2015. Revenues for CMOS image sensors in camera modules used in PCs and tablet computers are projected to rise by a CAGR of about 6% to $973 million in 2020, while sensor sales for stand-alone digital cameras are expected to shrink by a CAGR of -2% to 623 million in five years, according to IC Insights’ new O-S-D Report.

Worldwide CMOS image sensor revenue grew 12% in 2015 to $9.9 billion, which was the fifth consecutive record-high annual sales volume achieved by this optoelectronics product category since 2011. The 2016 O-S-D Report’s forecast shows CMOS image sensors continuing to set record-high sales levels for at least another five years in a row, growing by a CAGR of 9.0% from 2015 to 2020. In the previous five-year period (2010-2015), CMOS image sensor sales increased by a CAGR of 17.0% with much of that strong annual growth rate being driven by the market’s recovery from the severe economic recession in 2008-2009 and the emergence of new embedded camera applications and image-recognition system interfaces, which are now fueling the next wave of growth in imaging devices.

Report Details: The 2016 O-S-D Report

In a one-of-a-kind study, IC Insights continues to expand its coverage of the semiconductor industry with detailed analysis of trends and growth rates in the optoelectronics, sensors/actuators, and discretes market segments in its newly revised 360-page O-S-D Report—A Market Analysis and Forecast for the Optoelectronics, Sensors/Actuators, and Discretes.

Now in its 11th annual edition, IC Insights' 2016 O-S-D Report contains a detailed forecast of sales, unit shipments, and selling prices for more than 30 individual product types and categories through 2020. Also included is a review of technology trends for each of the segments. The 2016 O-S-D Report, with more than 240 charts and figures, is attractively priced at $3,390 for an individual-user license and $6,490 for a multi-user corporate license.

To review additional information about IC Insights’ new and existing market research reports and services please visit our website: www.icinsights.com.

More Information Contact

For more information regarding this Research Bulletin, please contact Rob Lineback, Senior Market Research Analyst at IC Insights. Phone: +1-817-731-0424, email: rob@icinsights.com

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- 4G Intellectual Property Royalties Set to Quadruple over the Next Five Years

- CMOS Image Sensors See Higher Growth from Greater Diversity of Uses

- Mixel MIPI D-PHY IP Integrated into Teledyne e2v Snappy CMOS Image Sensors

- CMOS Image Sensors Stall in "Perfect Storm" of 2022

Latest News

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s

- BrainChip Enables the Next Generation of Always-On Wearables with the AkidaTag© Reference Platform

- eSOL and Quintauris Partner to Expand Software Integration in RISC-V Automotive Platforms

- PQShield unveils ultra-small PQC embedded security breakthroughs

- CAST Introduces 400 Gbps UDP/IP Hardware Stack IP Core for High-Performance ASIC Designs