Accelerating Vehicle Electrification and Intelligence to Drive Automotive Semiconductor Market to Nearly US$100 Billion by 2029

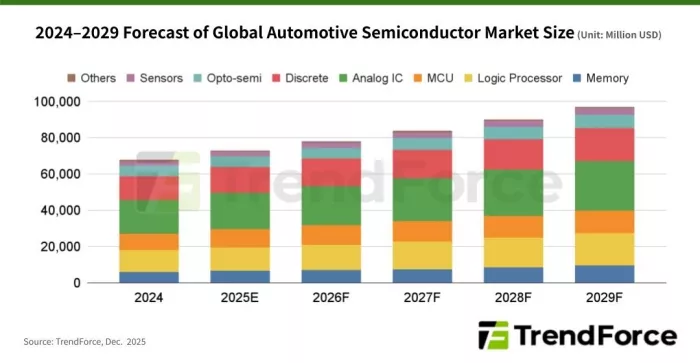

December 17, 2025 -- TrendForce’s latest investigations indicate that the rapid acceleration of vehicle electrification and intelligence is expected to propel the global automotive semiconductor market from approximately US$67.7 billion in 2024 to nearly $96.9 billion by 2029, representing a CAGR of 7.4% over the 2024–2029 period.

However, growth across automotive semiconductor segments is highly uneven. HPC chips, represented by logic processors and advanced memory, are expanding at a significantly faster pace than traditional components such as MCUs. This divergence reflects a rapid shift in market value toward core technologies that enable vehicle intelligence and electrification.

TrendForce research reveals that global EV penetration, including BEVs, PHEVs, FCVs, and HEVs, is expected to hit 29.5% of new-vehicle sales by 2025. Meanwhile, automakers are fast-tracking vehicle intelligence, which depends on multi-sensor configuration, high-speed connectivity, and AI model deployment.

A parallel shift is occurring in E/E architectures, progressing from distributed setups to domain-centric and fully centralized systems. The rapid growth in sensor data and the increasing complexity of AI models are driving a substantial increase in the demand for automotive computing capacity.

Automakers are exploring different levels of functional integration in areas like body control, telematics, intelligent driving, and smart cockpits, where semiconductor vendors are crucial. As chipmakers develop integrated cockpit-ADAS SoCs, 2025 will see the start of the commercialization of this converged architecture.

Controller consolidation reduces the number of ECUs, enables component sharing, simplifies wiring harnesses, and delivers cost benefits that are expected to accelerate the adoption of vehicle intelligence further. TrendForce estimates that automotive logic processors will post a CAGR of 8.6% from 2024 to 2029, outperforming the overall market average of 7.4%.

Competition intensifies as new entrants challenge incumbents

With growth rates diverging across semiconductor categories, competition among chipmakers is intensifying. Nvidia, a dominant force in the server market, and Qualcomm, a leader in mobile chipsets, are aggressively expanding into automotive intelligence by leveraging high-performance processors and robust hardware-software ecosystems.

Chinese players such as Horizon Robotics are also rising rapidly, supported by technological advances, localization policies, and strong demand for intelligent vehicle solutions. While traditional automotive semiconductor suppliers face mounting pressure, their broad product portfolios, proven reliability, and deep customer relationships remain key competitive advantages.

TrendForce observes that the automotive semiconductor landscape is highly diverse, with each vendor facing distinct opportunities and challenges. Success in this evolving market will hinge on building strategic alliances across the ecosystem and strengthening hardware-software integration capabilities. Pure hardware performance alone is no longer sufficient to secure long-term competitiveness.

TrendForce’s “2025 Driving Intelligence Automotive Semiconductor Report” provides an in-depth analysis of how vehicle intelligence and E/E architecture evolution are reshaping the automotive semiconductor industry. The report provides detailed market forecasts for 2024–2029, examines shifts across key automotive semiconductor segments, and analyzes the competitive landscape among chipmakers. Access the report now to capture emerging opportunities in the automotive semiconductor transformation.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Global Semiconductor Sales Increase 15.8% Year-to-Year in April; New Industry Forecast Projects Market Growth of 16.0% in 2024

- SiFive and Arkmicro Accelerate RISC-V Adoption in Automotive Electronics with SiFive's Automotive IP for the High-end SoC Market

- 2024 Global Semiconductor Materials Market Posts $67.5 Billion in Revenue

- Semiconductor Market Post Growth but Face Slowdown

Latest News

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI

- QuickLogic Announces $13 Million Contract Award for its Strategic Radiation Hardened Program