Server DRAM and HBM Boost 3Q24 DRAM Industry Revenue by 13.6% QoQ, Says TrendForce

November 26, 2024 -- TrendForce’s latest investigations reveal that the global DRAM industry revenue reached US$26.02 billion in 3Q24, marking a 13.6% QoQ increase. The rise was driven by growing demand for DDR5 and HBM in data centers, despite a decline in LPDDR4 and DDR4 shipments due to inventory reduction by Chinese smartphone brands and capacity expansion by Chinese DRAM suppliers. ASPs continued their upward trend from the previous quarter, with contract prices rising by 8% to 13%, further supported by HBM’s displacement of conventional DRAM production.

Looking ahead to 4Q24, TrendForce projects a QoQ increase in overall DRAM bit shipments. However, the capacity constraints caused by HBM production are expected to have a weaker-than-anticipated impact on pricing. Additionally, capacity expansions by Chinese suppliers may prompt PC OEMs and smartphone brands to aggressively deplete inventory to secure lower-priced DRAM products. As a result, contract prices for conventional DRAM and blended prices for conventional DRAM and HBM are expected to decline.

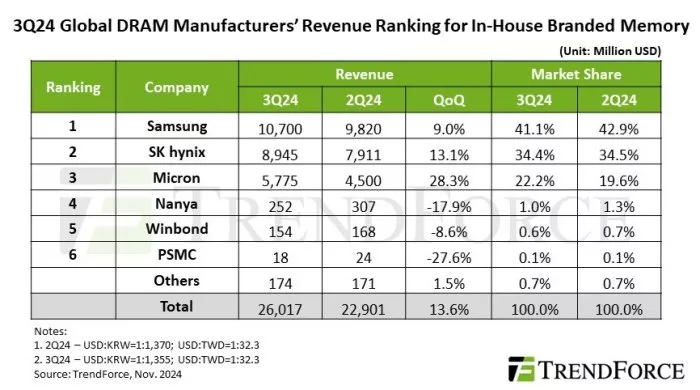

Server and PC DRAM contract price increases lifted revenues for the top three DRAM manufacturers. Samsung retained the top spot with revenue of $10.7 billion, up 9% QoQ. By strategic inventory clearing of LPDDR4 and DDR4, bit shipments remained flat compared to the previous quarter.

SK hynix reported $8.95 billion in revenue—a 13.1% QoQ increase—maintaining its second-place position. Although its HBM3e shipments ramped up, a 1%–3% QoQ decline in bit shipments from weaker LPDDR4 and DDR4 sales offset these gains. Micron saw its revenue surge by 28.3% QoQ to $5.78 billion, driven by strong growth in server DRAM and HBM3e shipments, which led to a 13% QoQ increase in bit shipments.

Taiwanese DRAM suppliers saw their revenues decline in 3Q24, falling significantly behind the top three manufacturers. Nanya Technology faced a more than 20% QoQ drop in bit shipments due to weaker consumer DRAM demand and intensified competition in the DDR4 market from Chinese suppliers. Its operating profit margin further deteriorated from -23.4% to -30.8%, reflecting losses from a power outage incident.

Winbond experienced an 8.6% QoQ decline in revenue, falling to $154 million, as consumer DRAM demand softened and bit shipments decreased. PSMC reported a 27.6% QoQ decline in revenue from its in-house consumer DRAM production. However, including foundry revenue, its total DRAM revenue rose 18% QoQ, driven by ongoing inventory replenishment from its foundry clients.

Related Semiconductor IP

- Low Latency DRAM Synthesizable Transactor

- Low Latency DRAM Memory Model

- Embedded OTP (One-Time Programmable) IP, 2Kx32 bits for 1.0V/2.6V DRAM

- Embedded OTP (One-Time Programmable) IP, 4Kx32 bits for 1.2V/2.5V DRAM

- DDR2-PHY command/address block for DRAM chip, BOAC ; UMC 90nm SP/RVT Low-K Logic Process

Related News

- Electronic System Design Industry Reports Revenue of $3.8 Billion in Q3 2022, ESD Alliance Reports

- Electronic System Design Industry Logs $3.9 Billion in Revenue in Q4 2022, ESD Alliance Reports

- DRAM Industry Q1 Revenues Decline 21.2% QoQ, Marking Third Consecutive Quarter of Downturn, Says TrendForce

- Electronic System Design Industry Logs $4 Billion in Revenue in Q1 2023, ESD Alliance Reports

Latest News

- PQSecure Collaborates with George Mason University on NIST Lightweight Cryptography Hardware Research

- Omni Design Technologies Advances 200G-Class Co-Packaged Optics IP Portfolio for Next-Generation AI Infrastructure

- Global Annual Semiconductor Sales Increase 25.6% to $791.7 Billion in 2025

- Fabless Startup Aheesa Tapes Out First Indian RISC-V Network SoC

- SmartDV and Mirabilis Design Announce Strategic Collaboration for System-Level Modeling of SmartDV IP