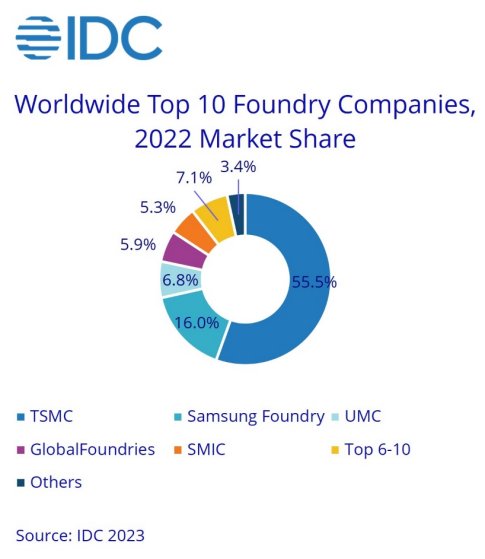

Worldwide Semiconductor Foundry Market Grew 27.9% YoY in 2022, Projected to Decrease by 6.5% YoY in 2023 due to Inventory Adjustments, IDC Finds

SINGAPORE, June 29, 2023 – According to IDC’s Semiconductor Manufacturing Services: 2022 Worldwide Foundry Market: Vendor Ranking and Insight, the worldwide foundry market size grew by 27.9% in 2022, hitting a new record high, benefiting from customers' long-term agreements (LTAs), higher foundry prices, process shrinkage, and plant expansion.

"The foundry industry plays a key role in the semiconductor supply chain. The top 10 vendors all reported double-digit revenue growth in 2022. However, due to changes in market conditions, order revisions had led to a sharp drop in the capacity utilization of foundries in the last three quarters,” said Galen Zeng, Senior Research Manager, Semiconductor Research, IDC Asia/Pacific. ”There is still rigid demand for semiconductors in the market and it is expected that after the supply chain has experienced more than one year of de-inventory, subsequent order planning will turn from being negative to steady and conservative. Coupled with the AI boom, this will slowly drive a recovery in capacity utilization of 5%–10%," Zeng adds.

Looking back at 2022, the foundry industry performed well. Among the top 10 semiconductor foundry vendors are TSMC, Samsung Foundry, UMC, GlobalFoundries, SMIC, HHGrace, PSMC, VIS, Tower, Nexchi. The leading vendor, TSMC, has its advanced processes continued to evolve, with its market share increasing from 53.1% in 2021 to 55.5% in 2022. Driven by the recent gradual increase in orders for 3/4/5nm wafers, TSMC's market share is expected to pick up further in 2023. In addition, Chinese foundry vendors actively developed mature processes, gaining a total market share of 8.2% in in 2022, compared with 7.4% in 2021, in addition to their respective revenue growth of over 30%. Observations based on the capacity utilization show that integrated circuit (IC) designers had actively stocked up till the first half of 2022 (1H22), and the signing of long contracts further promoted the foundry price to remain robust and the capacity utilization to reach 90%–100%. However, from the second quarter of 2022 (2Q22), the supply chain operations grew increasingly cautious and IC designers reduced orders with foundries, including drastic cuts in orders for some consumer ICs and cancellations of LTAs on them, resulting in top-heavy operations throughout 2022.

In 1H23, the purchase intentions for consumer electronics were low, and market demand showed no significant increase. Inventory adjustment for endpoint products will continue into the second half of the year. Although orders for AI- and high-performance computing (HPC)related wafers are abundant, some IC designers' products will also experience de-stocking and have inventory replenishment in 2H23. Demand for inventory is not all that optimistic amid the decline in LTAs and the fading price rise dividend. Considering the high baseline of the previous year, IDC expects the worldwide foundry market size to drop slightly by 6.5% in 2023. The foundry segment will fall slightly compared with the overall semiconductor supply chain, and the whole industry is projected to get back on track in 2024.

For more information on this IDC report, please contact Helen Chiang at hchiang@idc.com. For media inquiries, please contact Angel Wu at anwu@idc.com or Miguel Carreon at mcarreon@idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC's analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world's leading tech media, data and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDCAP and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

Related Semiconductor IP

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

Related News

- The Worldwide Semiconductor Market is expected to increase 13.9 percent in 2022, continuing to grow by 4.6 percent in 2023.

- The Worldwide Semiconductor Market is expected to slow to 4.4% growth in 2022, followed by a decline of 4.1% in 2023

- The Worldwide Semiconductor Market is expected to slow to 4.4 percent growth in 2022, followed by a decline of 4.1 percent in 2023

- Gartner Forecasts Worldwide Semiconductor Revenue Growth to Slow to 7% in 2022

Latest News

- Cadence Reports Fourth Quarter and Fiscal Year 2025 Financial Results

- Renesas Develops 3nm TCAM Technology Combining High Memory Density and Low Power, Suitable for Automotive SoCs

- RaiderChip showcases the evolution of its local Generative AI processor at ISE 2026

- ChipAgents Raises $74M to Scale an Agentic AI Platform to Accelerate Chip Design

- Avery Dennison announces first-to-market integration of Pragmatic Semiconductor’s chip on a mass scale