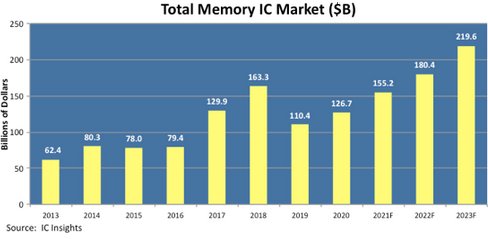

Memory Upswing Returns, New Record High Expected in 2022

Fueled by economic recovery and the transition to a digital economy, memory IC sales are forecast to reach $180.4 billion in 2022, exceeding the previous record high set in 2018.

May 20, 2021 -- IC Insights recently updated its forecast for 33 major IC product categories, including DRAM and NAND flash, in its April Update to the 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (MR21). The updated forecast shows that after a steep drop in 2019, sales of memory ICs rebounded 15% during COVID-plagued 2020. Following up on that increase, stronger DRAM pricing is expected to lift total memory revenue 23% this year to $155.2 billion. The average selling price for DRAM jumped 8% sequentially in the first quarter of this year, and nearly all of the leading memory suppliers stated in their most recent quarterly financial presentations that they expected stronger demand in 2Q21.

Figure 1

The memory upturn is forecast to continue into 2022 when total memory sales are expected to rise 16% to $180.4 billion, which would break the previous all-time high of $163.3 billion set in 2018 at the peak of the previous memory cycle. The memory market is forecast to reach its next cyclical peak in 2023, when revenue grows to nearly $220.0 billion—smashing through the $200.0 billion sales level for the first time—before a cooling period returns in 2024. From 2020 through 2025, IC Insights forecast the total memory market will grow by a CAGR of 10.6%.

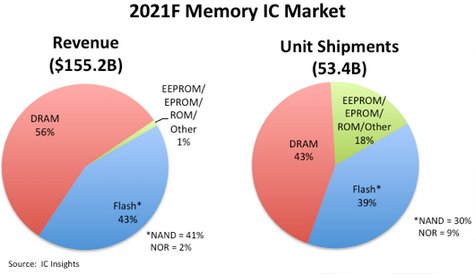

In 2021, DRAM is expected to account for 56% of the memory market (Figure 2) with flash memory accounting for 43% share. DRAM is also forecast to represent the bulk of memory unit shipments this year. Though there remains a viable market for other memory products (EEPROM, EPROM, ROM, SRAM, etc.), it is unlikely these segments will account for much more marketshare than they currently do.

Figure 2

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

Related News

- 2022 Semiconductor Sales to Grow 11% After Surging 25% in 2021

- Semi Content in Electronic Systems Reached Record High in 2021

- 2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

- Global Semiconductor Materials Market Revenue Tops $64 Billion in 2021 to Set New Record, SEMI Reports

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor