2019 Microprocessor Slump Snaps Nine Years of Record Sales

MPU market being pulled down by weakness in smartphones and servers, as well as the fallout from the U.S. China trade war. A modest rebound is expected in 2020, followed by new all-time high sales in 2021.

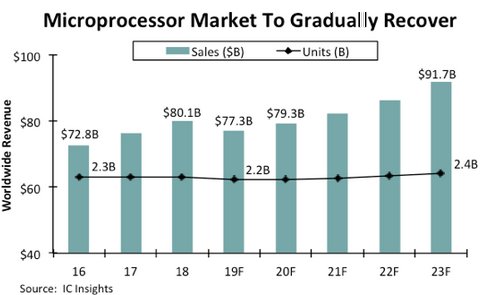

October 11, 2019 -- The microprocessor market’s string of nine straight record-high annual sales between 2010 and 2018 is expected to end this year with worldwide MPU revenue dropping 4% to about $77.3 billion because of weakness in smartphone shipments, excess inventories in data center computers, and the global fallout from the U.S.-China trade war, according to IC Insights’ recently updated forecast. Microprocessor sales are expected to stage a modest rebound in 2020, growing 2.7% to $79.3 billion (Figure 1) and then are forecast to reach a new record-high level of about $82.3 billion in 2021, based on IC Insights’ outlook for MPUs in the Mid-Year Update to the 2019 McClean Report.

Figure 1

The Mid-Year Update projection pulls in the previously expected 2020 slowdown in MPU sales to this year and deepens the decline compared to the 2019 McClean Report’s original January forecast, which showed a 3.9% increase in microprocessor sales in 2019 followed by a negligible decrease of 0.1% in 2020. Total MPU revenue is now expected to increase by a compound annual growth rate (CAGR) of 2.7% between 2018 and 2023, reaching $91.7 billion in the final year of the forecast. Total microprocessor shipments are projected to rise by a CAGR of just 1.0% in the forecast period to reach 2.4 billion units in 2023.

About 29% of microprocessor dollar-sales volume in 2019 is expected to come from cellphone application processors ($22.2 billion) and 3% from similar mobile MPUs in tablet computers ($2.5 billion). Nearly 52% of total MPU revenue in 2019 is forecast to come from central microprocessors used in notebook and desktop PCs, “thin-client” Internet/cloud-computing systems, servers, mainframes and supercomputers ($39.8 billion). Nearly all of the central-processing unit MPUs in computers are based on the x86-based designs sold by Intel and rival Advanced Micro Devices and just 1% of the sales total having RISC architectures, such as those licensed by SoftBank’s ARM subsidiary in the U.K.

About 17% of total MPU sales in 2019 are now expected to come from embedded-processing applications ($12.9 billion), says the Mid-Year Update of the 2019 McClean Report. Embedded MPUs continue to be a bright spot in the market with sales forecast to grow 10% in 2019 from $11.7 billion in 2018, when these processors represented about 15% of total microprocessor revenue. Embedded processor sales are being driven by increased connection to the Internet of Things (IoT), growing automation and artificial intelligence in systems, and the spread of sensors in cars, industrial equipment, consumer products, and other end-use applications.

Report Details: The 2019 McClean Report

Additional details on the MPU market are provided in the Mid-Year Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

Related News

- Hewlett-Packard Becomes First System Manufacturer to License Moore Microprocessor Patent(TM) Portfolio

- Casio Joins HP in Purchasing ''System'' License to Use Moore Microprocessor Patent(TM) Portfolio; Casio Reinforces Need for Digital Hardware Manufacturers to License Ubiquitous MMP Portfolio Technologies

- Fujitsu Purchases License to Intellectual Property Protected by Moore Microprocessor Patent(TM) Portfolio

- AMD To Provide Transmeta Efficeon Microprocessor Supporting Microsoft FlexGo Technology In Emerging Markets

Latest News

- A new CEO, a cleared deck: Is Imagination finally ready for a deal?

- SkyeChip’s UCIe 3.0 Advanced Package PHY IP for SF4X Listed on Samsung Foundry CONNECT

- Victor Peng Joins Rambus Board of Directors

- Arteris Announces Financial Results for the Fourth Quarter and Full Year 2025 and Estimated First Quarter and Full Year 2026 Guidance

- Arteris Network-on-Chip Technology Achieves Deployment Milestone of 4 Billion Chips and Chiplets