76% of IC Products Expected to See Flat/Negative Growth in 2019

After flying high for two years, DRAM sales growth is forecast to rank last in 2019, worst among all IC categories; NAND flash sales decline close behind.

August 8, 2019 -- IC Insights recently released its Mid-Year Update to The McClean Report 2019. The update included IC Insights’ 2019 ranking of revenue growth rates for the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization.

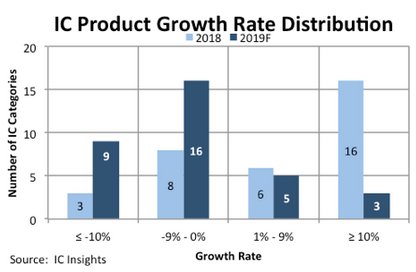

Figure 1 shows the distribution of growth rates for the 33 IC product categories in 2018 and IC Insights’ forecast for 2019. In an ugly turnaround from last year, growth rates in 2019 are expected to be heavily weighted toward the negative side of the chart, with nine segments forecast to see a sales decline of 10% or more and 16 product categories expected to experience flat sales or a single-digit decline in revenue growth. Eight of 33 IC product categories are forecast to see an increase in sales in 2019, led by Industrial/Other—Special Purpose Logic, which is forecast to jump 38% this year, followed by Display Drivers and PLDs. In 2018, 22 IC product categories experienced sales growth—16 of those with at least 10% growth.

Figure 1

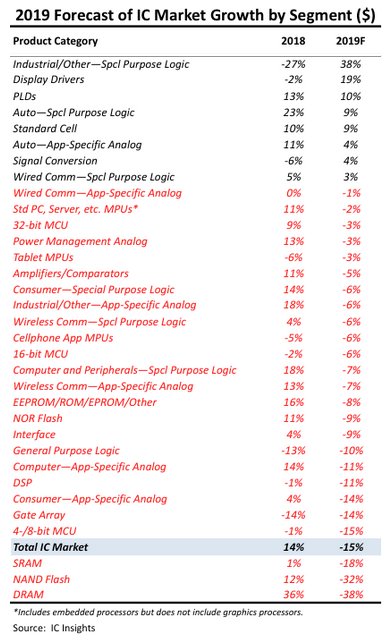

After two years of leading the industry in sales growth, the DRAM market is forecast to face the biggest decline this year, ranking it at the bottom of the 2019 sales growth list (Figure 2). NAND flash and SRAM are expected to join DRAM as the only categories with weaker growth than the total IC market (-15%).

Figure 2

Report Details: The 2019 McClean Report

Additional details on semiconductor and IC market trends are provided in the Mid-Year Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200-page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

Related News

- 2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

- Arm technology is defining the future of computing: Record royalties highlight increasing diversity of products and market segment growth

- Global Semiconductor Sales Increase 15.8% Year-to-Year in April; New Industry Forecast Projects Market Growth of 16.0% in 2024

- Global Top 10 IC Design Houses See 49% YoY Growth in 2024, NVIDIA Commands Half the Market, Says TrendForce

Latest News

- A new CEO, a cleared deck: Is Imagination finally ready for a deal?

- SkyeChip’s UCIe 3.0 Advanced Package PHY IP for SF4X Listed on Samsung Foundry CONNECT

- Victor Peng Joins Rambus Board of Directors

- Arteris Announces Financial Results for the Fourth Quarter and Full Year 2025 and Estimated First Quarter and Full Year 2026 Guidance

- Arteris Network-on-Chip Technology Achieves Deployment Milestone of 4 Billion Chips and Chiplets