Semiconductor Industry Capex Forecast to Slump in 2019 and 2020

Five of the past six semiconductor industry capex downturns have lasted two years before recovering

July 1, 2019 -- IC Insights will release its 200+ page Mid-Year Update to the 2019 McClean Report next month. A portion of the Mid-Year Update will examine semiconductor industry capital spending trends with an industry-wide forecast through 2023. In addition, the Update will include IC Insights’ capital spending forecast for each of the 32 major spenders for 2019 and 2020.

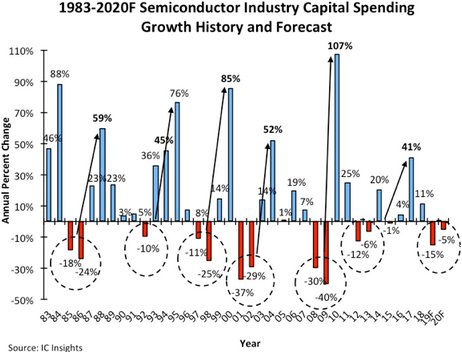

Figure 1 shows the annual capital spending changes from 1983 through IC Insights’ forecast for 2019 and 2020. Over the past 34 years, there have been six periods when semiconductor industry capital spending declined by double-digits rates for one or two years (1985-1986, 1992, 1997-1998, 2001-2002, 2008-2009, and 2012-2013).

In every case between 1983 and 2010 where spending declined, a surge in spending of at least 45% occurred two years later. The second year increases in spending after the cutbacks were typically stronger than the first year after a downturn since most semiconductor producers acted very conservatively coming out of the slowdown and waited until they had logged 4-6 quarters of good operating results before significantly increasing their capital spending again. This is expected to be the case for 2020 with most semiconductor producers likely to be very conservative with their spending budgets for next year given the poor semiconductor market expected in 2019. IC Insights believes that Micron’s attitude toward next year’s capital spending outlook will be representative of the industry in general. In its most recent conference call, Micron stated that, “For fiscal 2020, we plan for capex to be meaningfully lower than fiscal 2019.”

As shown in Figure 1, the streak of strong ≥45% capital spending growth two years after spending cutbacks ended in 2015, with capital spending registering a 1% decline. Moreover, only a 4% increase occurred 2016. Although capital spending jumped by 41% in 2017 (four years after the 2012-2013 downturn in spending), IC Insights believes that the relatively muted cyclical behavior of the capex growth rates since 2013, as compared to past cycles, is another indication of a maturing semiconductor industry.

Figure 1

Report Details: The 2019 McClean Report

Additional details on IC market and capital spending trends are provided in The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including a 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2019 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Virtusa Acquires Bengaluru based SmartSoC Solutions, Establishing Full-Stack Service Offering from Chip to Cloud and Driving Expansion into the Semiconductor Industry

- Eleven Companies Forecast to Account for 78% of Semi Capex in 2017

- "Billion Dollar Capex Club" Forecast to Swell to 15 Companies in 2017

- Semi Capex Forecast to Exceed $100B for the First Time in 2018

Latest News

- GlobalFoundries Announces Availability of AutoPro150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- Axiomise Launches nocProve for NoC Verification

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility