Significant Mid-Year Revision to 2017 IC Market Forecast

DRAM, NAND flash memory markets drive the first annual double-digit upturn since 2010.

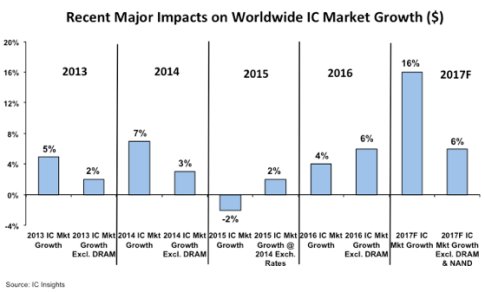

August 3, 2017 -- IC Insights has revised its outlook and analysis of the IC industry and presented its new findings in the Mid-Year Update to The McClean Report 2017, which originally was published in January 2017. Entering the second half of the year, it is clear the IC industry is on course for a much stronger upturn than was initially forecast in January. IC Insights now expects the IC market to increase 16% in 2017 due to exceptional growth in the DRAM and NAND flash memory markets. The DRAM market is now forecast to grow 55% and the NAND flash market is now expected to rise 35% this year—in both cases, almost entirely due to fast-rising prices rather than unit growth. Excluding these two markets, the overall IC market growth is forecast to show just 6% year-over-year growth (Figure 1). The expected 16% increase would be the first double-digit gain for the IC market since it expanded by 33% in 2010—the recession-recovery year—and the fifth double-digit increase for the IC market since 2000.

Figure 1

As seen in the figure, the DRAM market has had a notable impact on total IC market growth in recent years. With market surges of 32% and 34% in 2013 and 2014, respectively, the DRAM market alone boosted the worldwide IC market growth rate by three percentage points in 2013 and four percentage points in 2014.

At $64.2 billion, the DRAM market is forecast to be by far the largest single product category in the IC industry in 2017, exceeding the expected second-ranked MPU market for standard PCs and servers ($47.1 billion) by $17.1 billion this year.

Overall, IC Insights’ global economic outlook remains on course with initial projections covered in The McClean Report. Electronic system production, capital spending as a percent of sales, and IC wafer capacity added were unchanged from the original outlook. However, other factors and conditions that contribute to the forecast were upgraded slightly in the Mid-Year Update. For example, the worldwide GDP forecast was upgraded by 0.1 point to 2.7% for 2017, marginally ahead of what is considered to be the global recession threshold of 2.5% growth. IC Insights believes that through the forecast period, annual IC market growth rates will closely track with the performance of worldwide GDP growth.

Following a fairly strong first half of growth, China’s 2017 GDP was raised to 6.8% for 2017 from the original forecast of 6.3%. Also, IC Insights upgraded its U.S GDP forecast to 2.1% in the Mid-Year Update from 2.0% in January. While the U.S. economy is far from perfect, it is currently one of the most significant positive driving forces in the worldwide economy. A falling unemployment rate, PMI figures of 57.0 and 55.8 in the first and second quarters of this year, and relatively low oil prices should help the U.S. economy sustain its modest growth in the second half of this year. Growth rates for IC unit shipments, IC average selling price, and semiconductor capital spending were also revised slightly higher.

Additional details and commentary regarding the updated IC forecasts for the 2017-2021 timeperiod are covered in IC Insights’ Mid-Year Update to The McClean Report 2017.

Report Details: The 2017 McClean Report

Details on the IC market forecast and trends within the IC industry are provided in the 2017 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2017). A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2017 edition of The McClean Report is priced at $4,090 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,090.

To review additional information about IC Insights’ new and existing market research reports and services please visit our website: www.icinsights.com.

More Information Contact

For more information regarding this Research Bulletin, please contact Bill McClean, President at IC Insights. Phone: +1-480-348-1133, email: bill@icinsights.com

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Eleven Companies Forecast to Account for 78% of Semi Capex in 2017

- "Billion Dollar Capex Club" Forecast to Swell to 15 Companies in 2017

- Semiconductor Industry Capital Spending Forecast to Jump 20% in 2017

- Wafer Shipments Forecast to Increase in 2017, 2018 and 2019

Latest News

- GlobalFoundries Announces Availability of AutoPro150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- Axiomise Launches nocProve for NoC Verification

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility