Gartner Forecasts Worldwide Semiconductor Revenue to Grow 17% in 2024

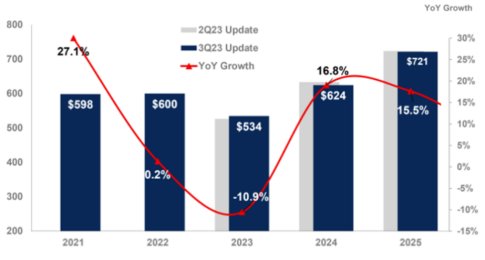

STAMFORD, Conn. -- December 4, 2023 -- Global semiconductor revenue is projected to grow 16.8% in 2024 to total $624 billion, according to the latest forecast from Gartner, Inc. In 2023, the market is forecast to decline 10.9% and reach $534 billion.

“We are at the end of 2023 and strong demand for chips to support artificial intelligence (AI) workloads, such as graphics processing units (GPUs), is not going to be enough to save the semiconductor industry from double-digit decline in 2023,” said Alan Priestley, VP Analyst at Gartner. “Reduced demand from smartphones and PC customers coupled with weakness in data center/hyperscaler spending are influencing the decline in revenue this year.”

However, 2024 is forecast to be a bounce-back year where revenue for all chip types will grow (see Figure 1), driven by double-digit growth in the memory market.

Figure 1. Semiconductors Revenue Forecast, Worldwide, 2021-2025 (Billions of U.S. Dollars)

Source: Gartner (December 2023)

Memory Revenue to Rebound in 2024 After Double-Digit Decline

The worldwide memory market is forecast to record a 38.8% decline in 2023 and will rebound in 2024 by growing 66.3%.

Anemic demand and declining pricing due to massive oversupply will lead NAND flash revenue to decline 38.8% and fall to $35.4 billion in revenue in 2023. Over the next 3-6 months, NAND industry pricing will hit bottom, and conditions will improve for vendors. Gartner analysts forecast a robust recovery in 2024, with revenue growing to $53 billion, up 49.6% year-over-year.

Due to high oversupply level and lack of demand, DRAM vendors are chasing the market price down to reduce inventory. Through the fourth quarter of 2023, DRAM market’s oversupply will continue which will trigger a pricing rebound. However, the full effect of pricing increases will only be seen in 2024, when DRAM revenue is expected to increase 88% to total $87.4 billion.

Integrating AI Techniques Will Generate New Servers

Developments in generative AI (GenAI) and large language models are driving demand for deployment of high-performance GPU-based servers and accelerator cards in data centers. This is creating a need for workload accelerators to be deployed in data center servers to support both training and inference of AI workloads. Gartner analysts estimate that by 2027, the integration of AI techniques into data center applications will result in more than 20% of new servers including workload accelerators.

Gartner clients can read more in “Forecast Analysis: Semiconductors and Electronics, Worldwide” and “Semiconductors and Electronics Forecast, 3Q23 Update, Presentation Materials.”

About Gartner for High Tech

Gartner for High Tech equips tech leaders and their teams with role-based best practices, industry insights and strategic views into emerging trends and market changes to achieve their mission-critical priorities and build the successful organizations of tomorrow. Additional information is available at www.gartner.com/en/industries/high-tech.

Related Semiconductor IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

- 50G PON LDPC Encoder/Decoder

- UALink Controller

Related News

- Gartner Says Worldwide Semiconductor Revenue Grew 21% in 2024

- Gartner Forecasts Worldwide AI Chips Revenue to Reach $53 Billion in 2023

- Gartner Forecasts Worldwide Semiconductor Revenue to Grow 14% in 2025

- Gartner Says Worldwide Semiconductor Revenue Grew 18% in 2024

Latest News

- Honda and Mythic Announce Joint Development of 100x Energy-Efficient Analog AI Chip for Next-Generation Vehicles

- PQSecure Collaborates with George Mason University on NIST Lightweight Cryptography Hardware Research

- Omni Design Technologies Advances 200G-Class Co-Packaged Optics IP Portfolio for Next-Generation AI Infrastructure

- Global Annual Semiconductor Sales Increase 25.6% to $791.7 Billion in 2025

- Fabless Startup Aheesa Tapes Out First Indian RISC-V Network SoC