Semiconductor industry sees revenue increase for the first time since 2021

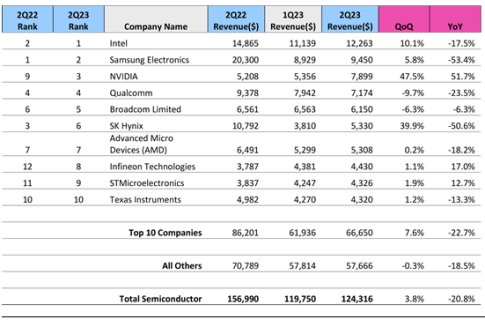

LONDON, September 7, 2023 – After five straight quarters with declining revenue, the semiconductor industry reversed course and increased revenue in 2Q23 according to the latest Omdia’s Competitive Landscape Tracker. The research noted quarterly revenue grew 3.8% to $124.3 bn in this period. This growth is in line with historical patterns for the total semiconductor market, with the second quarter revenue increasing on average of 3.4% from the first quarter (using data from 2002 through 2022). However, growth within semiconductor segments continues to diverge from historical trends. For example, the DRAM market was up 15% in 2Q23 with the historical pattern of 7.5% in the second quarter.

The growth is a welcome sign for the semiconductor industry after the longest period of declines since Omdia began tracking the market in 2002. However, the toll of the shrinking market has reduced the current market considerably, with the semiconductor market by revenue now at 79% of what it was one year ago when total revenue was $160bn in 2Q22. It will take time to return to the revenue levels of late 2021.

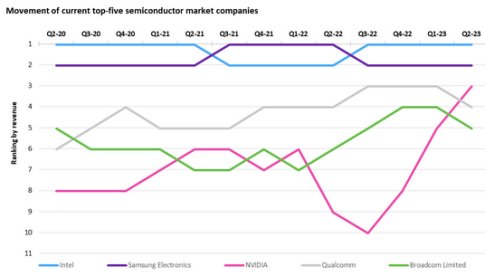

NVIDIA led the semiconductor turnaround in 2Q23. Industry wide, semiconductor revenue grew $4.6 bn from the previous quarter, and $2.5bn of that increased quarterly revenue came from NVIDIA alone. The rapid, recent growth in demand for generative AI, a market that NVIDIA dominates, is pushing NVIDIA up the market share rankings.

The data processing segment, driven by AI chips into the server space, grew 15% quarter-over-quarter (QoQ) and makes up nearly one-third of semiconductor revenue (31% in 2Q23). The wireless segment (dominated by smartphones) is the second largest segment and declined 3% QoQ as end-demand in this sector continues to be weak. The automotive semiconductor sector continues to grow, up 3.2%.

NVIDIA has led the turnaround, increasing semiconductor revenue 47.5% from the previous quarter. One year ago, NVIDIA was the 9th largest semiconductor company by revenue, at the end of Q2-23 the ranking is third. While NVIDIA was the biggest influence on the growing market, most major firms also contributed to the growth. Of the top ten firms, eight increased semiconductor revenue in 2Q23, illustrating that the turnaround is not limited to one sector of the overall market.

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- Electronic System Design Industry Reports Revenue of $3.8 Billion in Q3 2022, ESD Alliance Reports

- Electronic System Design Industry Logs $3.9 Billion in Revenue in Q4 2022, ESD Alliance Reports

- Electronic System Design Industry Logs $4 Billion in Revenue in Q1 2023, ESD Alliance Reports

- Electronic System Design Industry Posts $4 Billion in Revenue in Q2 2023, ESD Alliance Reports

Latest News

- UMC Reports Sales for February 2026

- Rambus Sets New Benchmark for AI Memory Performance with Industry-Leading HBM4E Controller IP

- Panmnesia Signs Strategic Partnership with Openchip at MWC26

- proteanTecs Receives Strategic Investment from TOPPAN Group Venture Arm TGVP

- Altera Advances FPGA-Based Physical AI for Robotics and Edge Applications