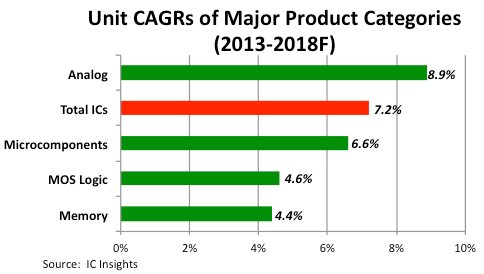

Analog Unit Shipments Outpacing Growth of All IC Product Segments

Average annual analog IC unit growth rate forecast from 2013-2018 raised to 8.9%, surpassing all other major product categories and total IC shipment growth.

July 28, 2014 -- IC Insights will release its Mid-Year Update to the 2014 McClean Report at the end of this month. The Mid-Year Update shows that between 2013 and 2018, analog unit shipments are forecast to grow at an average annual rate of 8.9%, faster than the 7.2% forecast for the total IC market and faster than all other major IC product categories (Figure 1). Analog unit shipments grew 15% in 2013 to become the first IC product category to ship more than 100 billion units in a calendar year period and are forecast to grow another 12.4% in 2014.

Figure 1

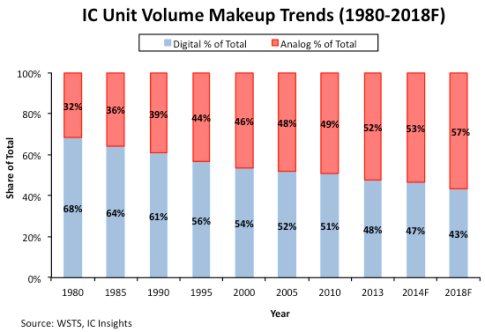

Analog unit shipments as a percentage of total IC shipments have been on the increase for more than 30 years (Figure 2) due to single-chip integration of digital ICs and ongoing system growth that necessitates more and more analog ICs. In 1980, analog ICs represented 32% of total IC shipments, but that increased to nearly 40% in 1990, 46% in 2000, 49% in 2010, and is forecast to grow to 57% of total IC shipments in 2018.

Figure 2

Demand for medical/health electronics, LED lighting systems, and green energy management systems (lighting, temperature, security, etc.) for homes and commercial buildings is expected to keep analog unit growth much more robust than other IC product categories through the forecast period. Starting in 2013 and in each year through 2018, analog IC unit growth is forecast to exceed total IC unit growth.

Report Details: The 2014 McClean Report

More figures and additional details on IC unit shipment trends are provided in the 2014 edition of IC Insights’ flagship report, The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. This highly regarded service features more than 900 pages and more than 400 tables and graphs that provide the user with a thorough analysis of IC industry trends throughout the year. A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2014 edition of The McClean Report is priced at $3,490 and includes an Internet access password. A multi-user worldwide corporate license is available for $6,490.

To review additional information about IC Insights’ new and existing market research reports and services please visit our website: www.icinsights.com.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Semiconductor Unit Shipments To Exceed One Trillion Devices in 2016

- Semiconductor Unit Shipments To Exceed One Trillion Devices in 2017

- Microcontroller Unit Shipments Surge but Falling Prices Sap Sales Growth

- Semiconductor Unit Shipments To Exceed One Trillion Devices in 2018

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI