After Hitting 11-Year High in Q4, Semiconductor Inventories Set to Decline Slightly in Q1

March 21, 2012

Sharon Stiefel

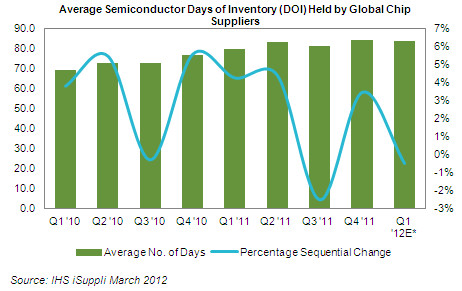

Despite rising by a worrisome 3.4 percent and hitting an 11-year high in the fourth quarter of 2012, average semiconductor days of inventory (DOI) held by chip suppliers are expected to decline by 0.5 percent in the first quarter, providing some hope that market conditions are improving.

Amid slow demand and continued excess production, average global semiconductor stockpiles held by chip suppliers rose to 84.1 DOI in the fourth quarter, up from 81.3 in the third quarter, according to an IHS iSuppli Inventory Market Brief report from information and analytics provider IHS (NYSE: IHS). However, demand is predicted to rise in the first quarter, drawing down stockpiles to 83.7 DOI, as presented in the figure below.

“The fourth quarter of 2011 proved disappointing from both a revenue as well as earnings standpoint,” said Sharon Stiefel, analyst for semiconductor market intelligence at IHS. “Global semiconductor revenue declined by 2.8 percent compared to the fourth quarter of 2010 as customer orders declined. Meanwhile, semiconductor suppliers struggled to balance their factory utilization levels against the drop in demand, leading to the rise in semiconductor inventories.”

Semiconductor inventories in the fourth quarter of 2011 were at their highest level since the first quarter of 2001. Excess inventory can represent a challenge for the semiconductor, particularly in times of declining demand, causing prices to decline and resulting in factories reducing their manufacturing.

However, there are signs that conditions in the semiconductor market are improving.

“Semiconductor suppliers are projecting a resumption of demand in the first quarter,” Stiefel observed. “Book-to-bill ratios are reaching parity, and global macroeconomic indicators point to a healthier outlook. These factors are raising optimism among semiconductor suppliers that better days are ahead for the industry.”

At the close of the fourth quarter financial reporting season, the main message from semiconductor manufacturers was to put the past behind them and look ahead with hope to the future. A common theme echoed in many investor conference calls was that the bottom of the downturn has already been reached. As proof that the industry might be turning a corner, semiconductor suppliers pointed to improved bookings in January following the apparent end to customer inventory corrections.

“Should semiconductor demand rise more than projected, those companies holding excess inventory could turn that to their advantage later in 2012, because they will be in a better inventory position than those that have become too lean,” Stiefel said.

Learn More > Semiconductor Manufacturers Must Look to the Future, Not Dwell on the Past

IHS iSuppli's market intelligence helps technology companies achieve market leadership. Catch the latest semiconductor industry market research, semiconductor market research, semiconductor trends, supply chain industry from all across the world straight from our immensely experienced analysts. iSuppli provides comprehensive the ihs isuppli® semiconductor market research portal keeps you updated with latest supply chain industry trends and events. to learn more, call us at 310-524-4007. that is rigorous, reliable & relevant. To know more, send us an e-mail on info@isuppli.com or contact us on +1.310.524.4007.

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

Related News

- Rising Semiconductor Inventories in Q1 Signal Potential Recovery in Demand

- Global Semiconductor Sales Increase 18.8% in Q1 2025 Compared to Q1 2024; March 2025 Sales up 1.8% Month-to-Month

- SEMI Reports Typical Q1 2025 Semiconductor Seasonality with Potential for Atypical Shifts Due to Tariff Uncertainty

- Global Semiconductor Sales Increase 7.8% from Q1 to Q2; Month-to-Month Sales Tick Up 1.5% in June

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor