Mature Process Capacity to Grow 6% in 2025; Chinese Foundries Lead Expansion

October 24, 2024 -- The latest investigations by TrendForce reveal that Chinese foundries are set to drive the bulk of mature process capacity growth in 2025, thanks to China’s domestic IC substitution policies. It is estimated that the capacity of the world’s top 10 mature process foundries will increase by 6% in 2025, though pricing pressures will persist.

TrendForce noted that the demand for advanced and mature processes is showing a clear divergence. The 5/4 nm and 3 nm nodes, driven by AI servers, PC/notebook HPC chips, and new smartphone SoCs, will see full capacity utilization through the end of 2024. In contrast, mature nodes of 28 nm and above are experiencing only a moderate recovery, with average capacity utilization increasing by 5% to 10% in the second half of this year compared to the first.

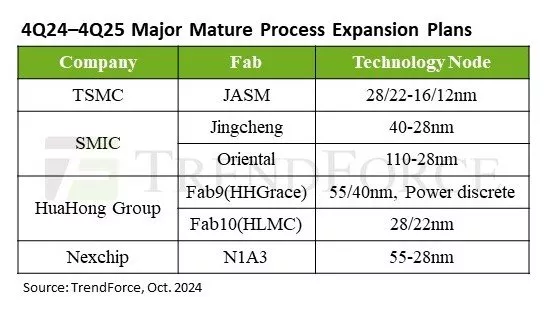

Ensuring regional capacity has become a key issue, especially as many end products and applications continue to rely on mature processes for peripheral IC production and geopolitical factors drive supply chain diversification. This is spurring the global expansion of mature process capacity. Major capacity expansion plans for 2025 include TSMC’s JASM fab in Kumamoto, Japan, as well as SMIC’s fabs in Lingang (Shanghai), Beijing, HuaHong Group’s Fab9 and Fab10, and Nexchip’s N1A3.

Shipments in smartphone, PC/notebook, and server markets (including both general-purpose and AI servers) are expected to recover and show year-over-year growth in 2025. Additionally, the automotive and industrial control sectors, which will have completed their inventory corrections throughout 2024, are expected to see a resurgence in demand supporting utilization rates in mature process capacity.

However, there are still concerns surrounding the global economic outlook and China’s recovery. End-device brands and upstream clients remain cautious in placing orders, resulting in short-term visibility of just one quarter for mature process orders. This leaves the outlook for 2025 uncertain. TrendForce forecasts that the capacity utilization rate for the top 10 global foundries’ mature processes will increase slightly to over 75% next year.

TrendForce highlighted that as new capacity from China comes online, Chinese foundries’ share of mature process capacity among the top 10 is expected to exceed 25% by the end of 2025. The highest increases will be seen in 28/22 nm production. Chinese foundries are also advancing their specialty process technologies, with the HV platform in particular expected to lead, and 28 nm already in mass production as of 2024.

Looking ahead to overall pricing trends in 2025, mature process pricing is expected to remain under pressure due to average capacity utilization remaining below 80% and new capacity still needing orders to fill. However, Chinese foundries may exert more pricing leverage due to continued localization efforts and the need for upstream clients to secure domestic capacity in China. This could help alleviate some of the downward pressure on mature process pricing, potentially stabilizing prices after the corrections seen in 2H24 and creating a pricing standoff between supply and demand.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Related Semiconductor IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

- 50G PON LDPC Encoder/Decoder

- UALink Controller

Related News

- Progress in Importation of US Equipment Dispels Doubts on SMIC's Capacity Expansion for Mature Nodes for Now, Says TrendForce

- 2022 a Focus for 12-inch Capacity Expansion, 20% Annual Growth Expected in Mature Process Capacity, Says TrendForce

- European and Japanese IDMs Strengthen Collaboration with Chinese Foundries to Capture “China for China” Opportunities

- 4Q24 Global Top 10 Foundries Set New Revenue Record, TSMC Leads in Advanced Process Nodes, Says TrendForce

Latest News

- Honda and Mythic Announce Joint Development of 100x Energy-Efficient Analog AI Chip for Next-Generation Vehicles

- PQSecure Collaborates with George Mason University on NIST Lightweight Cryptography Hardware Research

- Omni Design Technologies Advances 200G-Class Co-Packaged Optics IP Portfolio for Next-Generation AI Infrastructure

- Global Annual Semiconductor Sales Increase 25.6% to $791.7 Billion in 2025

- Fabless Startup Aheesa Tapes Out First Indian RISC-V Network SoC