Record Spending for Fab Equipment Expected in 2017 and 2018

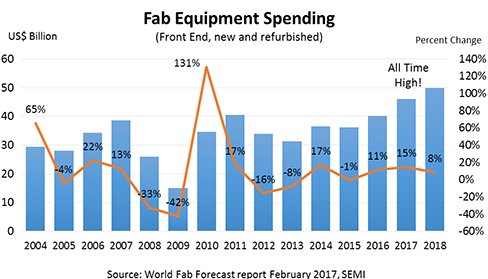

MILPITAS, Calif. – March 7, 2017 – Today, SEMI announced updates to its World Fab Forecast report, revealing that fab equipment spending is expected to reach an industry all-time record − more than US$46 billion in 2017. The record is expected to be broken again in 2018, nearing the $50 billion mark. These record-busting years are part of three consecutive years of growth (2016, 2017 and 2018), which has not occurred since the mid-1990s. The report has been the industry’s most trusted data source for 24 years, observing and analyzing spending, capacity, and technology changes for all front-end facilities worldwide. See Figure 1.

Figure 1: Fab Equipment Spending (Front End Facilities)

SEMI’s World Fab Forecast report (end of February 2017) provides updates to 282 facilities and lines equipping in 2017, 11 of which are expected to spend over $1 billion each in 2017. In 2018, SEMI’s data reflect 270 fabs to equip, with 12 facilities spending over $1 billion each. The spending is mainly directed towards memory (3D NAND and DRAM), Foundry and MPU. Other strong product segments are Discretes (with LED and Power), Logic, MEMS (with MEMS/RF), and Analog/Mixed Signal.

SEMI (www.semi.org) forecasts that China will be third for regional spending in 2017, although China’s annual growth is minimal in 2017 (about 1 percent), as many of the new fab projects are in the construction phase. China is busy constructing 14 new fabs in 2017 and these new fabs will be equipping in 2018. China’s annual spending growth rate in 2018 will be over 55 percent (more than $10 billion), and ranking in second place for worldwide spending in 2018. In total for 2017, China is equipping 48 fabs, with equipment spending of $6.7 billion; looking ahead to 2018, SEMI predicts that 49 fabs to be equipped, with spending of about $10 billion.

Other regions also show solid growth rates. The SEMI World Fab Forecast indicates that Europe/Mideast and Korea are expected to make the largest leaps in terms of growth rates this year with 47 percent growth and 45 percent growth, respectively, year-over-year (YoY). Japan will increase spending by 28 percent, followed by the Americas with 21 percent YoY growth.

The SEMI Industry Research & Statistics team has made 195 changes on 184 facilities/lines in the last quarter, with eight new facilities added and three fab projects cancelled. SEMI’s World Fab Forecast provides detailed information about each of these fab projects, such as milestone dates, spending, technology node, products, and capacity information. The World Fab Forecast Report, in Excel format, tracks spending and capacities for over 1,100 facilities including future facilities across industry segments. The SEMI World Fab Forecast and its related Fab Database reports track any equipment needed to ramp fabs, upgrade technology nodes, and expand or change wafer size, including new equipment, used equipment, in-house equipment, and spending on facilities for equipment. Also check out the Opto/LED Fab Forecast.

For more information about the SEMI World Fab Forecast, visit http://info.semi.org/semi-world-fab-forecast

About SEMI

SEMI® connects nearly 2,000 member companies and 250,000 professionals worldwide annually to advance the technology and business of electronics manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, and services that enable smarter, faster, more powerful, and more affordable electronic products. Since 1970, SEMI has built connections that have helped its members grow, create new markets, and address common industry challenges together. SEMI maintains offices in Bangalore, Beijing, Berlin, Brussels, Grenoble, Hsinchu, Seoul, Shanghai, Silicon Valley (Milpitas, Calif.), Singapore, Tokyo, and Washington, D.C. For more information, visit www.semi.org

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

Related News

- Fab Equipment Spending Breaking Industry Records

- Total Fab Equipment Spending Reverses Course, Growth Outlook Revised Downward

- Global Fab Equipment Spending to Rebound in 2020 with 20 Percent Growth

- 300mm Fab Equipment Spending to Seesaw, Reach New Highs in 2021 and 2023, SEMI Reports

Latest News

- ZeroRISC and Leading Research Institutions Deliver Production-Grade Post-Quantum Cryptography for Open Silicon

- GlobalFoundries Announces Availability of AutoPro 150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- MIPS and INOVA Collaborate to put Physical AI into the palm of Robotic hands with new Reference Platform

- Allegro DVT Launches DWP300 DeWarp Semiconductor IP

- Ubitium Tapes Out Universal Processor to End Embedded Computing Complexity Crisis